Index funds were introduced to address the challenges faced by investors in selecting a portfolio of securities that aligns with their financial goals. In today's market, with a wide range of companies listed on the stock exchange and various sub-categories based on market caps, themes, risk profiles, and credit ratings, the choices available to investors are abundant.

However, navigating through these options and continuously evaluating their risk profiles, growth prospects, and valuations can be daunting for investors. The process of active stock selection carries its own set of risks and requires expertise and continuous monitoring. Many investors may be hesitant to take on this stock selection risk altogether.

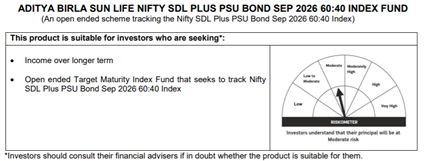

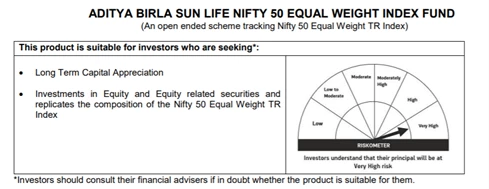

To cater to such investors, asset management companies (AMCs) have introduced index funds, which provide a passive investing model. These funds track and attempt to replicate the performance of a market index, eliminating the need for investors to individually select and manage securities. By investing in an index fund, investors can mitigate the active stock selection risk and gain exposure to a diversified portfolio of securities that align with the performance of the chosen index.

Index mutual funds come in different types – equity-based and debt-based. Equity-based can be further categorised based on market caps, themes and sectors, strategy, etc. The key benefit of index funds is the combination of diversification at low minimum investments, similar to other mutual funds, along with the advantage of lower active stock selection and lower costs.

1800-270-7000

1800-270-7000