-

Our Products

Our FundsOur High Return Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

Wealth Calculator

- Back

-

Shareholders

ABSL Conglomerate Fund NFO is Live now

Invest in Iconic Multi-Generational Businesses with Aditya Birla Sun Life Conglomerate Fund

What sets Conglomerates apart in India?

India's business landscape is shaped by the prominence of large conglomerates, many of which trace their roots to multi-generational enterprises. But what truly sets them apart?

-

Conglomerates –Strength in Diversity

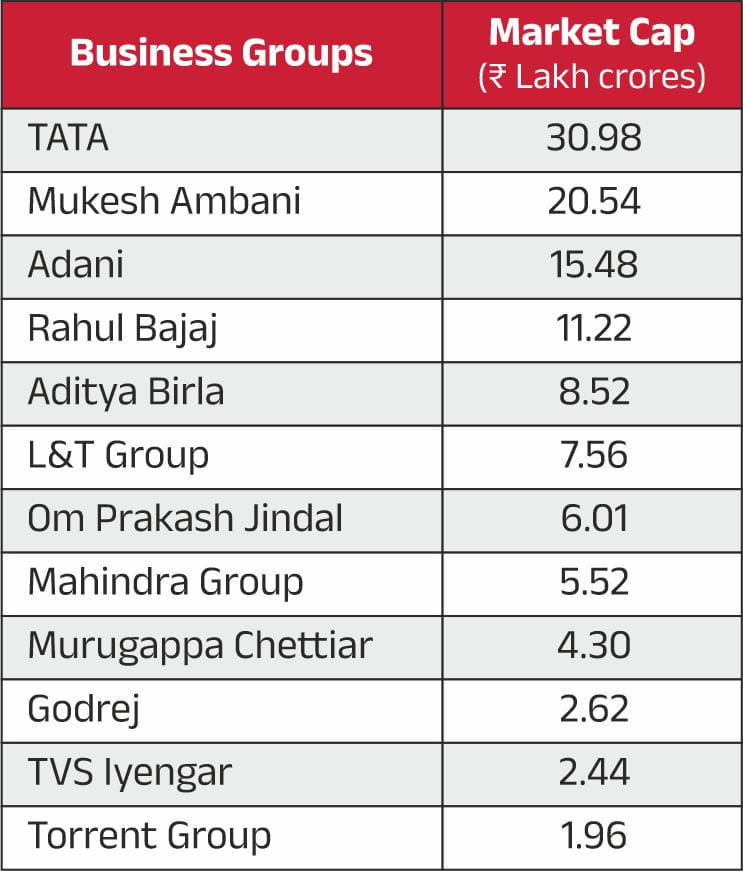

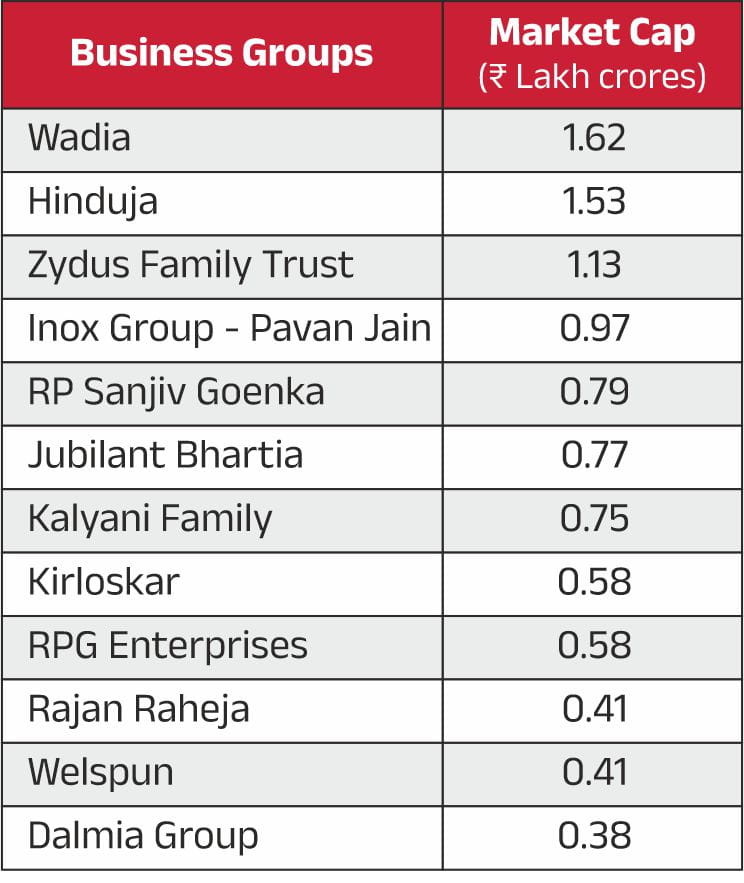

Indian conglomerates are groups controlled by promoters, consisting of two or more listed companies across a variety of sectors and industries. What starts as a family-owned business with a long-term vision for growth often expands into a diversified powerhouse operating at massive scales. Over time, these conglomerates evolve to dominate the market. In fact, conglomerates today account for a third of the total BSE market cap!

Source: Bloomberg, data as on 31-Oct-2024 -

What makes them investable?

These conglomerates are built on a strong legacy, supported by exceptional corporate governance. Their robust, diversified business models, combined with the ability to execute large-scale capital expenditures, make them potentially attractive investment opportunities.

-

From Belief to Investment: Aim to strengthen your portfolio

The success of these family-owned businesses is rooted in the multi-generational trust they have earned in the Indian market. Now is the ideal time to take your belief one step further—transition from being consumers of these iconic companies to becoming investors and let them help fuel growth in your portfolio.

-

Capitalise on the potential of conglomerates through a thematic fund

The conglomerate landscape today includes 169 companies spanning 22 sectors and varying market caps. A thematic fund focused on these high-potential companies for long-term value creation offers an effective way to invest in this dynamic space.

-

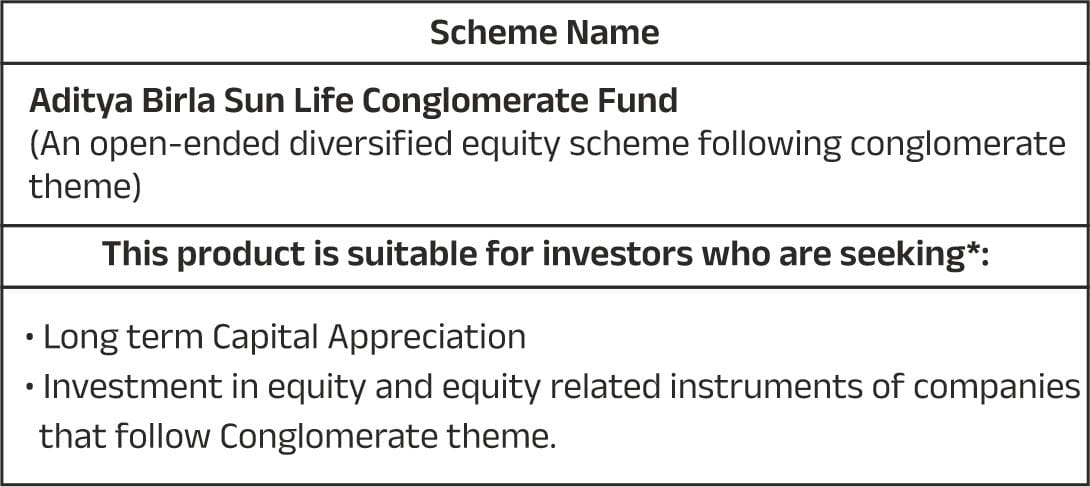

What it is?

An open-ended diversified equity scheme following conglomerate theme -

Investment Objective

To achieve long term capital appreciation by investing in equity and equity related securities of companies that follow the conglomerate theme.

The Scheme does not guarantee/indicate any returns. There is no assurance that the investment objective of the Scheme will be achieved. - Minimum Application Amount

For Lumpsum including Switch-in: Minimum of Rs.100/- and in multiples of Re. 1/- thereafter.

For Monthly, Weekly and Daily Systematic Investment Plan (SIP): Minimum of Rs. 100/- and in multiples of Re. 1/- thereafter

- Investment approach

The Scheme follows an active investment strategy. The investment will be in equity and equity related securities of companies that are part of the conglomerate in India. The Scheme would invest in a minimum of 4 groups and the exposure would be restricted to 25% of the net assets per group. This 25% may also be invested in the holding companies forming part of the top conglomerate. - Key Feature

A pioneering industry and category first thematic fund that leverages an expert, active investing strategy to capture companies following the conglomerate theme. It provides investors with convenient access to a diverse range of high-growth businesses of conglomerates, offering long-term growth potential.

Groups in the Conglomerate Universe

Conglomerates are multi-generational businesses known for their visionary leadership and robust corporate governance. Their strong business models and access to affordable capital drive sustained growth through scale and diversification. By investing in conglomerates, you tap into their long-term growth potential.

This fund stands out as the industry’s first and only category-specific fund focused on conglomerates, offering an investment opportunity.

The fund’s investment universe spans 41 industries, providing broad diversification. It also maintains limited exposure to banks, PSUs, and MNCs compared to other diversified funds.

The fund plans to allocate up to 10% to listed holding companies, offering the potential for long-term value unlocking.

The fund manager insight of the market brings in the ability to identify growth opportunities and enter/switch to rewarding businesses.

Features of ABSL Conglomerate Fund

An Equity based Thematic Equity Fund

This first-of-its-kind equity-oriented thematic fund invests up to 80% of its net assets in the equity of companies within the conglomerate sector.

Highly Diversified Portfolio

The fund's investable universe spans 41 industries, targeting around 20 sectors, ensuring strong diversification across a wide range of industries. It will also have a blend of large, mid, and small cap stocks in its portfolio.

Active Fund Management Strategy

The fund manager evaluates and selects companies from the conglomerate universe, based on growth prospects. The fund manager can take calculated bets on large groups and will have a higher tilt towards mid/small cap vs the benchmark

Suitable for Long-Term Investment

As an equity-oriented fund, the Aditya Birla Sun Life Conglomerate Fund is suitable for investors with a log-term horizon of 3-5 years or more.

Benefits of investing in a Conglomerate Fund

Offers investors exposure to leading conglomerates through a single investment.

Presents significant potential for long-term capital growth.

Ensures broad sectoral diversification across various industries.

Provides access to experienced fund managers for optimal portfolio construction.

Tax implications arise either upon receipt of IDCW (Income Distributed by the Fund) or on redemption of units.

• IDCW Taxation: IDCW is added to the investor’s total income and taxed at the applicable income tax slab rates.

• Capital Gains Tax:

-

If units are redeemed within 12 months, short-term capital gains tax is levied at 20% (plus applicable surcharge and cess).

-

If units are redeemed after 12 months, long-term capital gains tax is levied at 12.5% (plus applicable surcharge and cess) on capital gains exceeding Rs. 1.25 lakh per annum.

You can track the performance of your mutual fund investment through the mutual fund's official website or through the app or website of the distributor or broker through whom you invested.

A conglomerate fund invests in companies that operate across multiple industries, often owning a variety of businesses under one corporate structure. The fund typically targets large, diversified conglomerates, offering exposure to several sectors with a single investment. It is actively managed to select high-growth opportunities aiming for long-term capital appreciation.

During New Fund Offer and Ongoing Offer Period:

For Lumpsum including Switch-in: Minimum of Rs.100/- and in multiples of Re. 1/- thereafter.

For Monthly, Weekly and Daily Systematic Investment Plan (SIP): Minimum of Rs. 100/- and in multiples of Re. 1/- thereafter.

The expense ratio of a mutual fund refers to the annual fees expressed as a percentage of the fund’s daily net assets. It includes management fees, administrative costs, and other operational expenses.

For details on applicable expense ratio please refer to the Scheme Information Document of this fund.

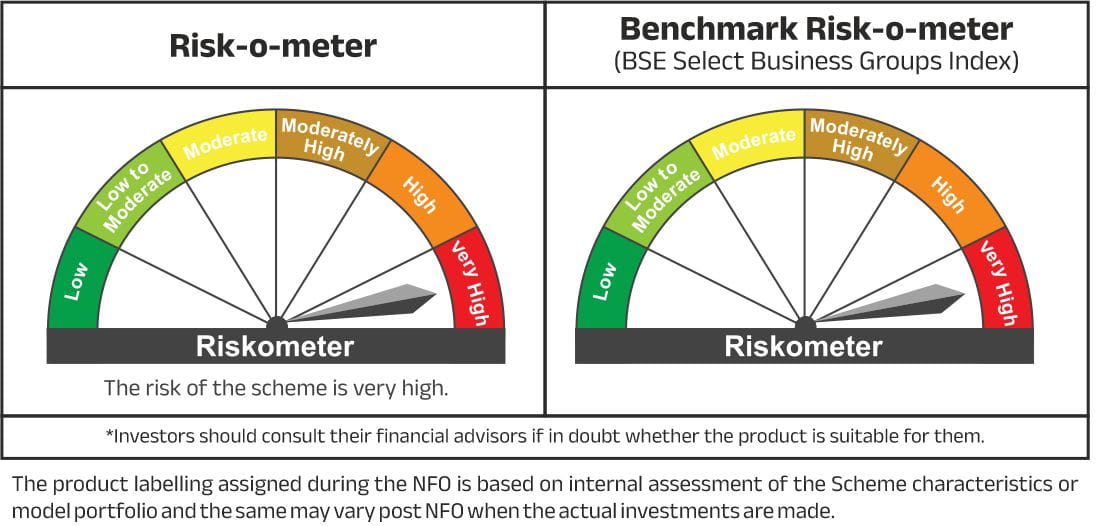

Investing in a thematic fund involves volatility and risk, as it focuses on companies within a specific theme. This fund invests in equities of Indian conglomerates, limiting its universe compared to broader markets. Risks include underperformance of conglomerates or market changes, which can negatively impact returns. While the fund can invest in large, mid, and small-cap stocks, mid and small-cap investments carry higher risk. Investors should be aware that the fund manager’s decisions may not always result in profits, despite the goal of capital appreciation.

The sector(s)/stock(s)/issuer(s) mentioned above do not constitute any research report/recommendation of the same and the fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

For more information on the scheme, please refer to SID/KIM of the scheme.

For more information on the scheme, please refer to SID/KIM of the scheme.

1800-270-7000

1800-270-7000