-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

What valuations of Indian banks are indicating?

Jun 25, 2024

5 Mins Read

Himanshu Taluja

Himanshu Taluja

Listen to Article

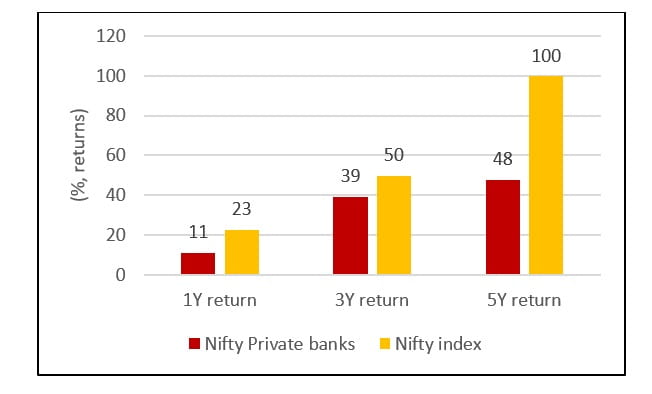

Indian banks continue to deliver strong fundamental performance on most fronts – growth, asset quality and return ratios. Despite this, Indian private banks have underperformed the Nifty Index on a one-year and three-year basis. In the last one year, the Nifty Private Bank Index has returned 11% against Nifty returns of 23%, while the private bank index has risen 38% against 50% for the Nifty in a three-year time frame.

Source: Bloomberg

However, over a longer-term period of 10 years, the Nifty Private Bank Index has outperformed the Nifty, confirming it’s a long-term compounder. In our view, the modest show in the recent past can be attributed to the following areas of concern: - Revenue growth slowdown on account of margin moderation whenever the interest rate cycle reverses - Unsecured lending - Slower liabilities momentum - and probably, a tighter regulatory stance coupled with concerns about frequent regulatory actions and what could potentially come next. Hence, private banks have de-rated despite strong fundamental performance on most parameters. Further, we believe that the long-term growth and profitability trajectory for Indian banks will be underpinned by their success in deposit mobilisation. Hence, the best liability franchise would be the one that can consistently deliver higher growth in liabilities at a lower cost vis-a-vis peers. Assessing the ingredients for a high-quality deposit franchise, we find large private banks ahead of peers with their larger branch network, greater share of primary accounts and greater success in tapping the corporate ecosystems. The asset quality is still in a sweet spot with the Net NPA’s ratio of the banking sector declining to decadal lows, driven by better asset quality and stronger provision buffers leading to controlled credit cost. Corporate slippage has been negligible in the last few years while recovery momentum has remained robust. The quality of corporate credit, too, has improved over the past 4-5 years. Further, private banks are less affected by ECL (Expected Credit Loss) Regulations and carry contingent buffers (large banks) and we do not expect any adverse asset quality while PSU banks can see some marginal impact of ECL regulations as contingent buffer cushions are less available to them. Source: Nuvama Research

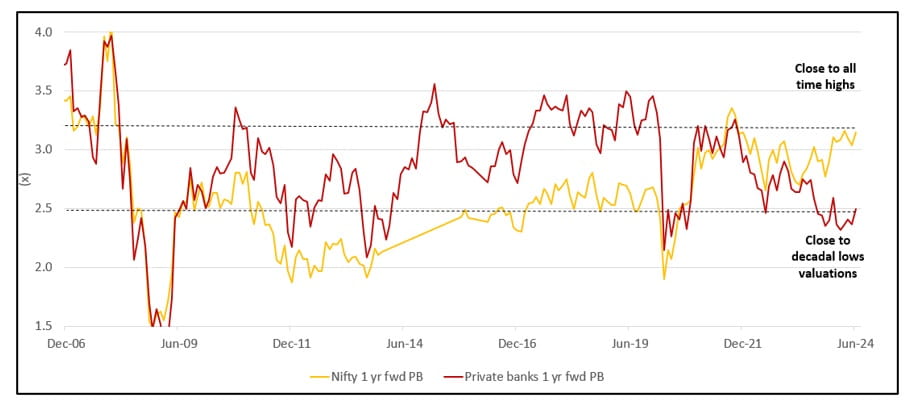

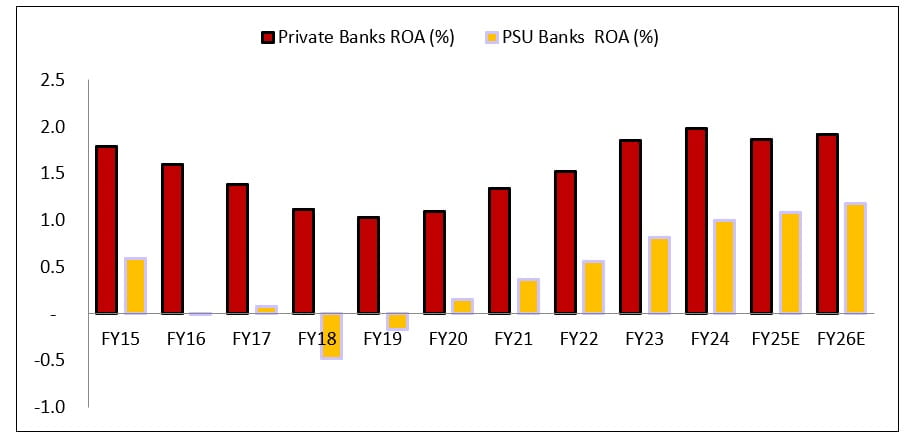

Overall, we expect private sector banks to report healthy ROAs and ROEs over the next couple of years, thus remaining a strong compounding growth story. We also expect healthy ROEs in the 16-18% range. Also, banks have underperformed the broader index by a wide margin in the last couple of years and thus valuations are now very compelling. Private banks currently trade at a 25-30% discount to Nifty on a one-year forward basis both on P/Earnings and P/Book Value ratios. Also, FII ownership has recently declined for private sector banks to ~43% v/s ~55% a decade ago. While for PSU Banks, FII ownership has increased in recent years. Hence, we see strong reasons for private sector banks to re-rate sharply driven by continued strong fundamental performance.

Source: ABSLAMC Research The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

Mutual Fund investments are subject to market risks, read all scheme related documents carefully. Indian banks have shown sharp improvement in return ratios, but private banks’ valuations are still closer to long-term averages

Price Performance

What could be the reasons?

Bank balance sheets have been the strongest in over a decade and Profit/ROE has rebounded sharply. Banks in general remain positive on their loan growth outlook as they continue to see good demand across segments. Some in fact, are exhibiting an increasing risk appetite in retail and MSME segments.

Also, capex in the last few years was majorly government-led. But with higher utilisation in private sector, banks expect gradual pick up in private capex as well. Overall, we remain positive on pick up in private capex, albeit at a gradual pace.

Private Banks Valuations comparison to Nifty stock valuations

Decadal high’s profitability trends

The article was first published in Financial Express on June 24, 2024

You May Also Like

Loading...

1800-270-7000

1800-270-7000