-

Our Products

Our FundsFocus Funds

-

Self Care

Self-ServiceFind InformationWays To TransactPartner Solutions

-

Downloads

- Learnings

- About Us

-

More

-

Shareholders

-

Shareholders

-

Updates

-

-

SIP Calculators

- Back

-

Shareholders

Trend Watch: Insights on the Indian Economy

Mar 12, 2024

2 Mins Read

Vinod Bhat

Vinod Bhat

Listen to Article

I had the opportunity to participate in a few conferences last month, where I engaged with a diverse array of industry experts and company leaders, gaining valuable insights from their perspectives and experiences.

In Asia, key macro data indicates that India is the only country in a full-blown business cycle upturn which could continue for the next 5 years.

Here are some interesting insights and trends I picked up.

Macro Environment

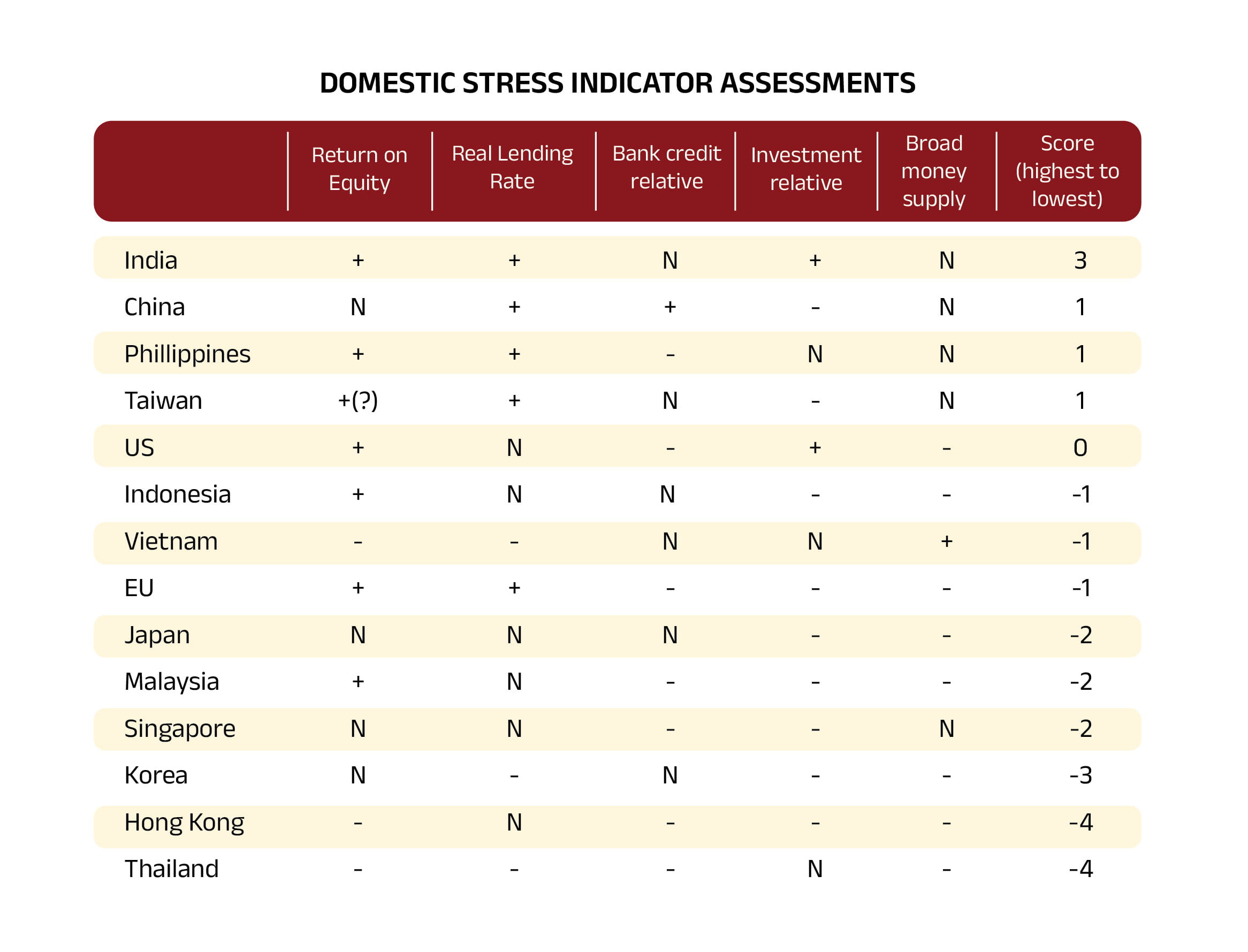

Jim Walker of Alethia Capital highlighted that based on domestic stress indicators such as Return on Equity (ROE), Real lending rate, Bank credit relative to Gross Domestic Product (GDP), Investment relative to GDP, and Broad money supply, India scores the highest.

In contrast, in China, ROE is on a downtrend and profit data does not support an upturn in credit or investments. With property prices on a downtrend, consumer confidence has also fallen sharply. And in Korea, Hong Kong, and Thailand, key indicators point to another tough year.

Source: Alethia Capital

In India, Credit and Investment cycles have been subdued for some time but that is no longer the case. Profits (signalled by Nifty or Sensex ROE) are providing a springboard for renewed business capital spending. After 8 years in a downturn, the Investment cycle has turned and has a lot further to go. We could see a 5-year upcycle. There is plenty of support from the banking system and non-food credit growth is leading nominal GDP growth for the first time since 2012. (Source: Isec)

Indian Economy – Consumption Trends

Consumption (at 60% of GDP) has been a big driver of India’s growth. And consumption itself has been driven by rising incomes.

Abheek Singhi from BCG highlighted four themes which are emerging:

Services – Services categories, especially health, education, and travel) are displaying faster growth (11-13% value growth) compared to product categories (6-8% value growth).

Premiumization – In various segments such as smartphones, auto, apparel, Fast Moving Consumer Goods (FMCG), Consumer Durables, etc., the premium segment is growing faster than the mass/value segment.

eCommerce – This channel is growing faster than offline. eCommerce has expanded 2x in the past 5 years and has seen a 40% CAGR over the past 10 years. A case in point here is an online marketplace founded in 2015 that facilitates trade between suppliers, resellers and customers which has already reached around 150 million monthly active users.

Small is big – Small towns are seeing much faster growth in consumption as compared to Tier I cities.

There is a prevailing myth that consumption is driven by youth, increasing urbanization, and men driving purchasing decisions. However, actual drivers of consumption are:

Middle and older age groups (35+): They are driving population growth.

Tier II or Bharat: Rate of increase in urbanization is gradual - only 2-3% per decade.

Women influencing purchasing decisions with better education: Women's enrolment in education has overtaken that of men for the first time.

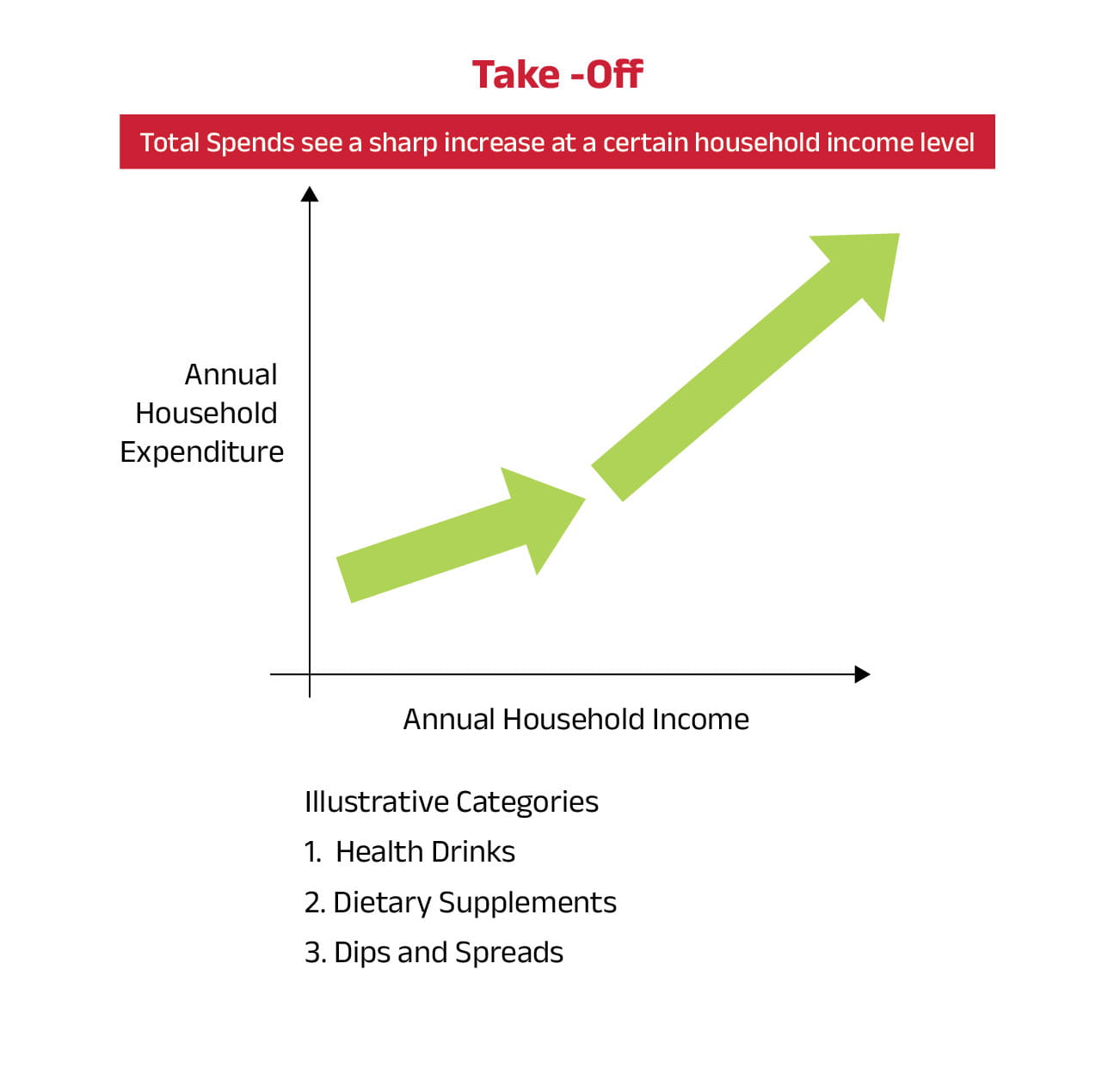

As incomes rise in India, not all consumption segments will benefit equally. The ‘S’ curve, which is typically seen in the technology sector may not hold in Consumption

Source: BCG

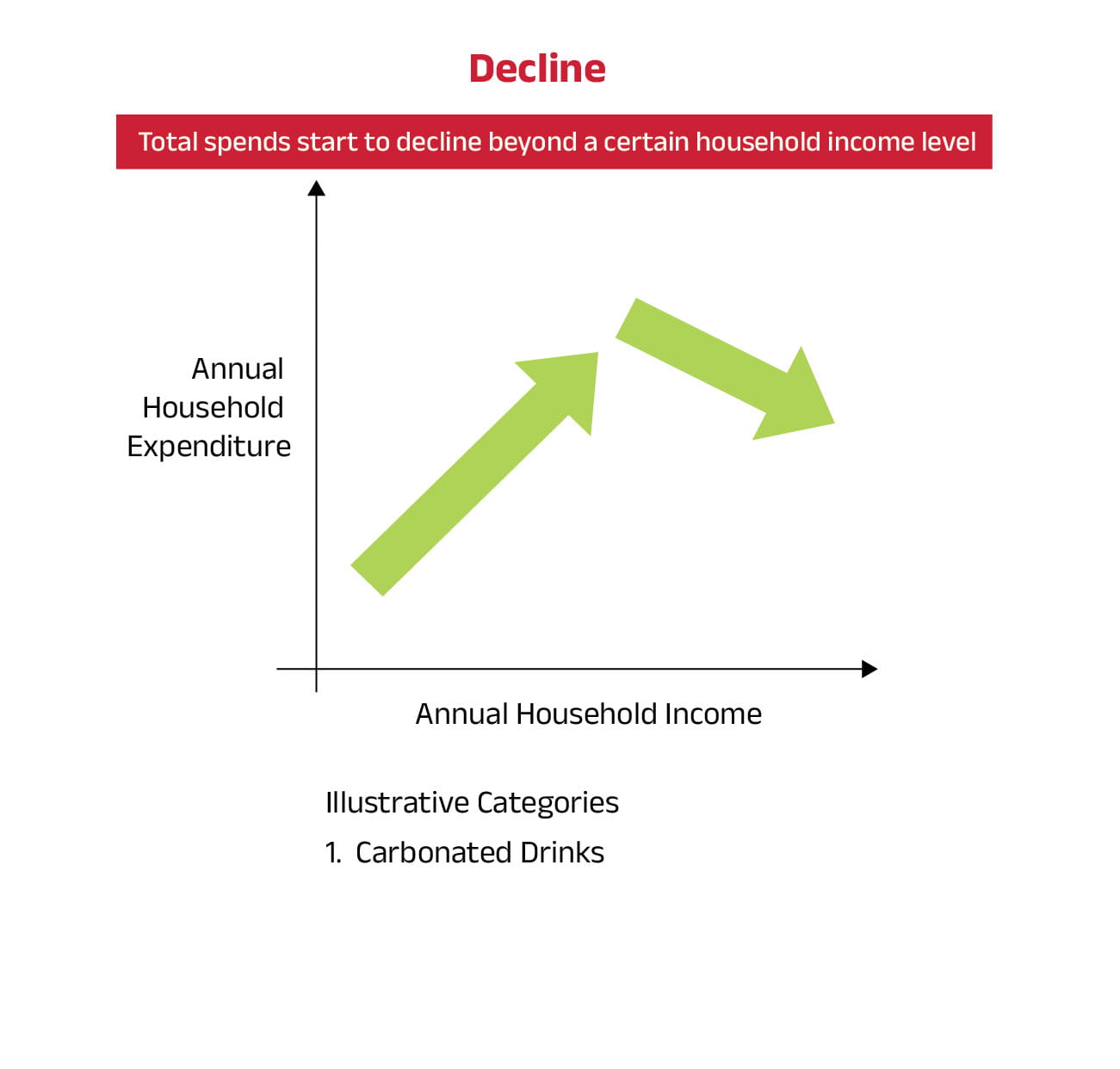

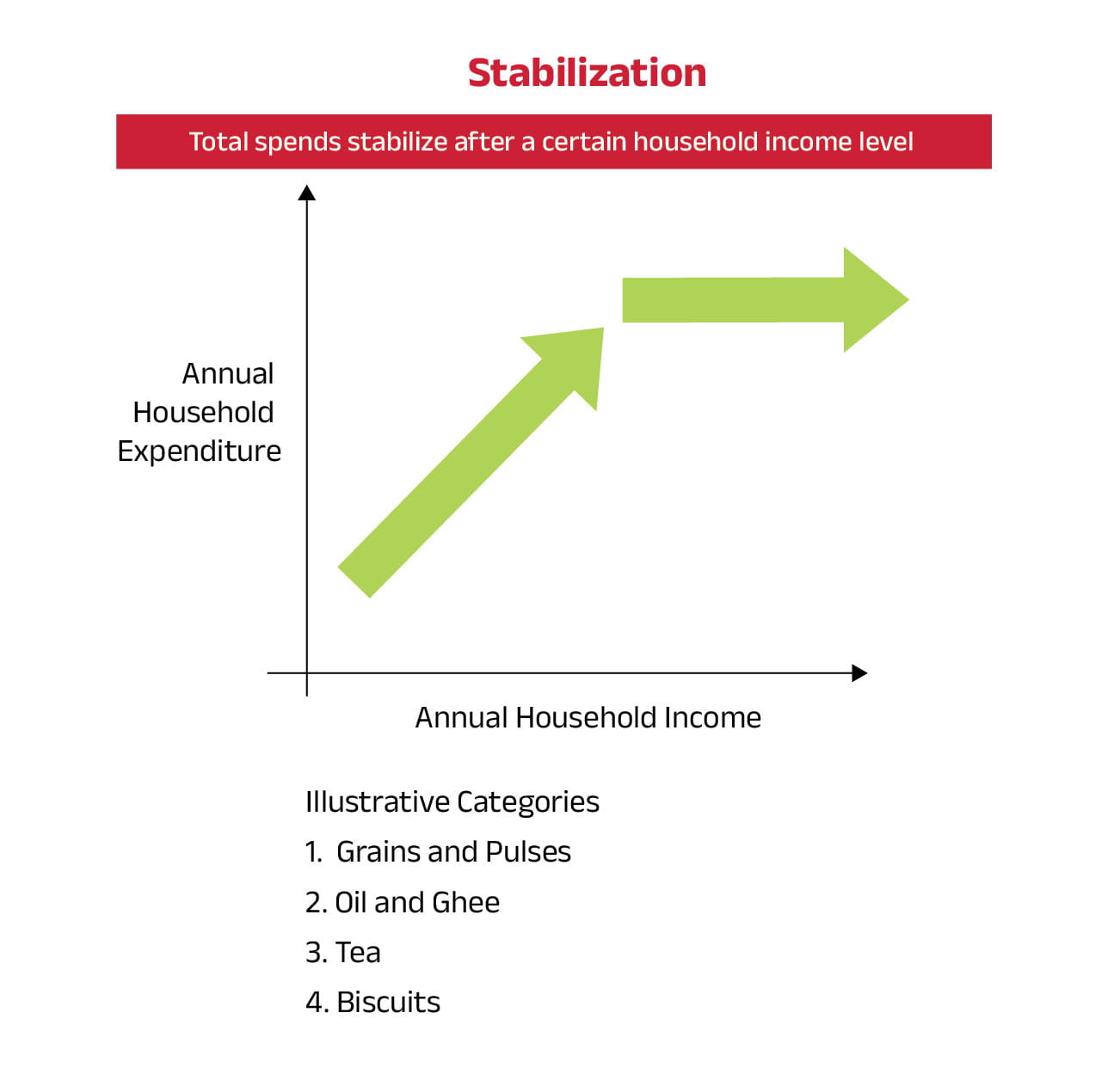

The chart above illustrates four trends in consumer spending on different categories as their income rises.

1. Take-off: Health drinks, dietary supplements, dips and spreads. In addition, travel and tourism is also likely to pick up as people prioritize experiences over goods consumption.

2. Linear: Milk, chocolates, Packaged snacks

3. Stabilization: Grains and pulses, oil and ghee, tea, biscuits

4. Decline: Carbonated drinks

Discretionary Consumption in India is a theme we are positive on as highlighted in our Annual Outlook. The chart above gives a good visualization of which consumption segments and companies may benefit as per capita income in India rises over the next decade.

Finally, an interesting point to note is that there are 10 consumer trends taking shape in India as shown in the chart below. Companies that tick 3 to 4 boxes in these trends have potential to see good tailwinds for growth. Top two trends to note are:

a. Indulgence (Every member of a household may be using different brands, less guilt in terms of spending on self)

b. Pride in Indian (higher than ever)

Source: BCG

The views expressed in this article are for knowledge/information purpose only and is not a recommendation, offer or solicitation of business or to buy or sell any securities or to adopt any investment strategy. Aditya Birla Sun Life AMC Limited (“ABSLAMC”) /Aditya Birla Sun Life Mutual Fund (“the Fund”) is not guaranteeing/offering/communicating any indicative yield/returns on investments. The sector(s)/stock(s)/issuer(s) mentioned do not constitute any research report/recommendation of the same and the Fund may or may not have any future position in these sector(s)/stock(s)/issuer(s).

You May Also Like

Loading...

1800-270-7000

1800-270-7000